oklahoma state auto sales tax

The value of a vehicle is its. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car.

Oklahoma Sales Tax Handbook 2022

Typically the tax is determined by.

. How Much Is the Car Sales Tax in Oklahoma. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Oklahoma charges two taxes for the purchase of new motor vehicles.

Senate Bill 1619 authored by Sen. In Oklahoma the excise tax is. 125 sales tax and 325 excise tax for a total 45 tax rate.

Oklahoma Sales Tax Guide Oklahoma charges 45 percent state sales tax on sales of tangible personal property and certain services. This is the largest of Oklahomas selective sales taxes in terms of revenue generated. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The excise tax is 3 ¼ percent of the value of a new vehicle.

Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in. To calculate the sales tax on your vehicle find the total sales tax. Darcy Jech R-Kingfisher would.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in. The Motor Vehicle Excise Tax on a new vehicle sale is 325.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change. Oklahoma City OK 73116.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Online Registration Reporting Systems. OKLAHOMA CITY On Wednesday the Senate approved Senate Bill 1075 to reinstate the full sales tax exemption on motor vehicles and tractor trailers.

Used vehicles are taxed a flat fee of 20 on. Counties and cities can charge an additional local sales tax of up to 65 for a. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The state also has some special taxes and levies. 4334 NW Expressway Suite 183. The public can also request a copy of the agenda via email or phone.

An example of an item that exempt from Oklahoma is. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at.

2018 Edition Max Platinum Ford Expedition For Sale In Oklahoma City Ok Cargurus

What S The Car Sales Tax In Each State Find The Best Car Price

8 Tips For Buying A Car Out Of State Carfax

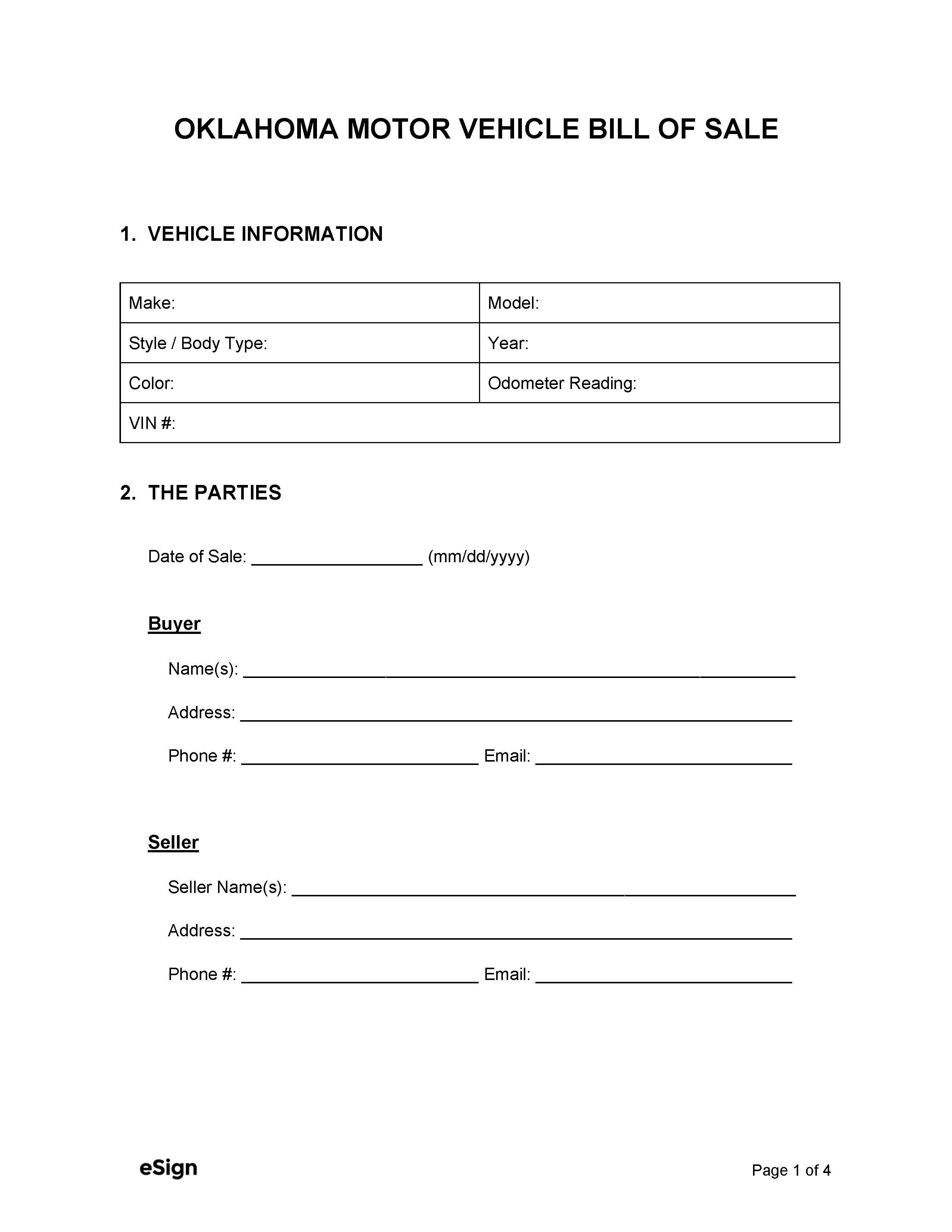

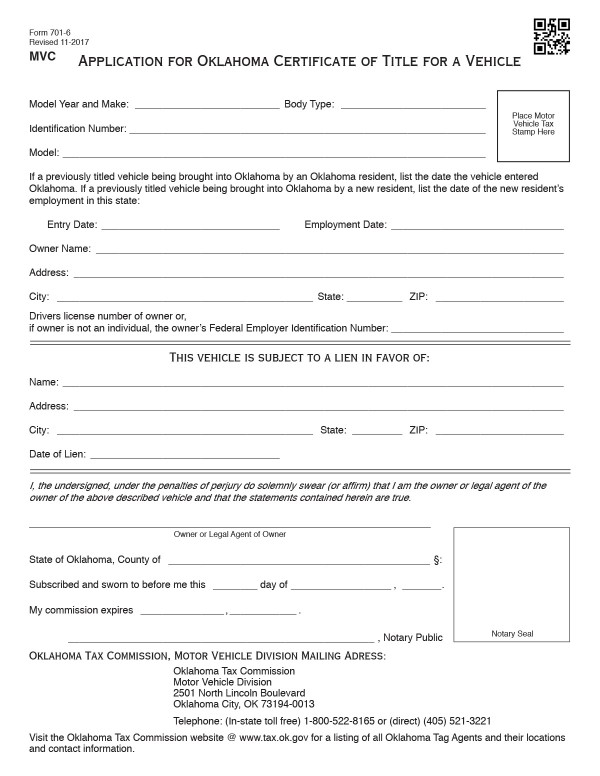

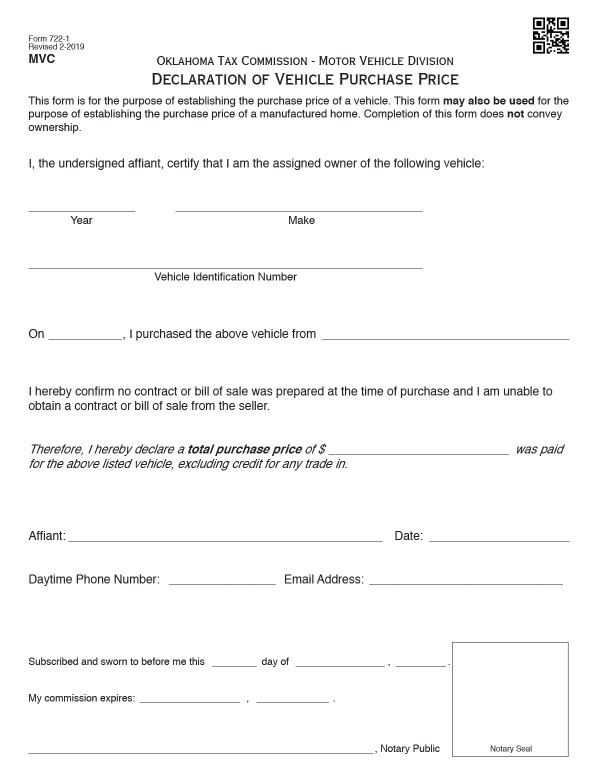

Bills Of Sale In Oklahoma The Templates Facts You Need

Sales Tax Laws By State Ultimate Guide For Business Owners

What New Car Fees Should You Pay Edmunds

Buying A Car Out Of State Here S What You Should Know Kfor Com Oklahoma City

Bills Of Sale In Oklahoma The Templates Facts You Need

Car Sales Tax In Oklahoma Getjerry Com

Tesla Asks Fans In Oklahoma And Mississippi To Fight New Bills To Ban Direct Sales Of Electric Cars Electrek

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Vehicle Title Tax Insurance Registration Costs By State For 2021

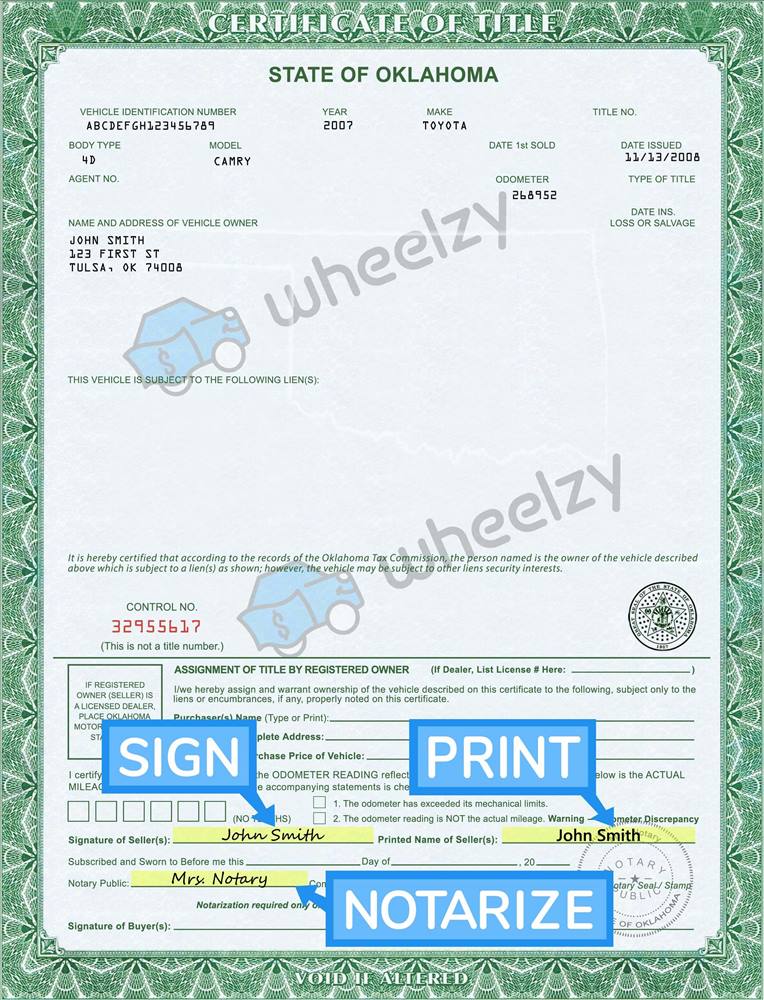

How To Sign Your Car Title In Oklahoma Including Dmv Title Sample Picture

Oklahoma Vehicle Registration And Title Information Vincheck Info

What S The Car Sales Tax In Each State Find The Best Car Price

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Title Transfer How To Sell A Car Quick At Fair Prices